[Most Recent Entries] [Calendar View] [Friends View]

Wednesday, August 25th, 2010

| Time | Event |

| 5:00p | Египет, общие сведения  MINISTRY OF PETROLEUM http://www.petroleum.gov.eg/en/ Ministry of Electricity and Energy http://www.moee.gov.eg/ Egypt's Information Portal http://www.eip.gov.eg/ http://www.petroleum.gov.eg/en/OtherSit Atlas of Egypt http://commons.wikimedia.org/wiki/Atlas Download Free Egypt Maps http://www.mapcruzin.com/free-egypt-map Карты http://www.hoeckmann.de/karten/afrika/a http://mapsof.net/egypt http://www.lib.utexas.edu/maps/egypt.ht http://www.lib.utexas.edu/maps/atlas_mi Лингвистическая карта http://www.muturzikin.com/carteafr Red Sea Naval Charts http://www.bluewater.de/red-sea/ka http://www.bluewater.de/redsea-inf Население, оценка (2009) - 77 420 000 чел. (15-е) 74 чел./км² Территория - 1 001 570 км² Годовой прирост — 2 % (фертильность — 3 рождения на женщину) http://ru.wikipedia.org/wiki/Егип GDP (PPP) 2009 estimate - Total $469.663 billion - Per capita $6,123 GDP (nominal) 2009 estimate - Total $187.954 billion - Per capita $2,450 Gini (1999–00) 34.5 (medium) http://en.wikipedia.org/wiki/Egypt  http://en.wikipedia.org/wiki/Demographi Треугольник Халаиба ( Read more... ) Высоты: самая низкая точка: Впадина Каттара −133 м самая высокая точка: Гора Святой Екатерины (Синай) 2629 м Спутниковое изображение Египта  Топографическая карта Египта  http://ru.wikipedia.org/wiki/Геогра Exports - $33.36 billion f.o.b. (2008 est.) Imports - $56.43 billion f.o.b. (2008 est.) Public debt - $28.84 billion (31 December 2008 est.) Revenues (доходы) - $40.46 billion (2008 est.) Expenses (расходы) -$51.38 billion (2008 est.) Egypt's mineral and energy resources include petroleum, natural gas, phosphates, gold and iron ore. Crude oil is found primarily in the Gulf of Suez and in the Western Desert. Natural gas is found mainly in the Nile Delta, off the Mediterranean shore, and in the Western Desert. Oil and gas accounted for approximately 7% of GDP in fiscal year 2000/01. Export of petroleum and related products amounted to $2.6 billion in the year 2000. In late 2001, Egypt's benchmark "Suez Blend" was about $16.73 per barrel ($105/m³), the lowest price since 1999. Deficit as % of GDP -7.97% Crude oil production has been in decline for several years since its peak level in 1993, from 941,000 bbl/d (149,600 m3/d) in 1993 to 873,000 bbl/d (138,800 m3/d) in 1997 and to 696,000 bbl/d (110,700 m3/d) in 2005.  At the same time, the domestic consumption of oil increased steadily (531,000 bbl/d and 525,000 bbl/d (83,500 m3/d) in 1997 and 2005 respectively), but in 2008, oil consumption reached to 697,000 bbl/day. It is easy to see from the graph that a linear trend projects that domestic demand outpaced supply in (2008–2009), turning Egypt to a net importer of oil. To minimize this potential, the government of Egypt has been encouraging the exploration, production and domestic consumption of natural gas. Oil Production was 630 bbl/day in 2008, and natural gas output continued to increase and reached 48.3 billion cubic meters in 2008. Over the last 15 years, more than 180 petroleum exploration agreements have been signed and multinational oil companies spent more than $27 billion in exploration companions. These activities led to the findings of about 18 crude oil fields and 16 natural gas fields in FY 2001. The total number of findings rose to 49 in FY 2005. As a result of these findings, crude oil reserves as of 2009 are estimated at 3.7 billion barrels (590,000,000 m3), and proven natural gas reserves are 1.656 trillion cubic meters with a likely additional discoveries with more exploration campaigns. In August 2007, it was announced that signs of oil reserves in Kom Ombo basin, about 28 miles (45 km) north of Aswan, was found and a concession agreement was signed with Centorion Energy International for drilling. The main natural gas producer in Egypt is the International Egyptian Oilfield Company (IEOC), a branch of Italian Eni. Other companies like BP, BG, Texas-based Apache Corp. and Shell carry out activities of exploration and production by means of concessions granted for a period of generally ample time (often 20 years) and in different geographic zones of oil and gas deposits in the country. Gold mining is more recently a fast growing industry with vast untapped gold reserves in the Eastern Desert. There is already a gold rush and gold production facilities are now reality from the Sukari Hills, located close to Marsa Alam in the Eastern Desert. The concession of the mine was granted to Centamin Egypt, an Australian joint stock company, with a gold exploitation lease for a 160-square-kilometer area. Sami El-Raghy, Centamin Chairman, has repeatedly stated that he believes Egypt's yearly revenues from gold in the future will exceed the total revenues from the Suez Canal, tourism and the petroleum industry combined. Egypt's excess of natural gas will more than meet its domestic demand for many years to come. The Ministry of Petroleum and Mineral Resources has established expanding the Egyptian petrochemical industry and increasing exports of natural gas as its most significant strategic objectives. Egypt and Jordan agreed to construct the Arab Gas Pipeline from Al Arish to Aqaba to export natural gas to Jordan; with its completion in July 2003, Egypt began to export 1.1 billion cubic feet (31,000,000 m3) of gas per year. Total investment in this project is about $220 million. In 2003, Egypt, Jordan and Syria reached an agreement to extend this pipeline to Syria, which paves the way for a future connection with Turkey, Lebanon and Cyprus by 2010. As of 2009, Egypt began to export to Syria 32.9 billion cubic feet (930,000,000 m3) of gas per year, accounting for 20% of total consumption in Syria. In addition, the East Mediterranean Gas (EMG), a joint company established in 2000 and owned by Egyptian General Petroleum Corporation (EGPC) (68.4%), the private Israeli company Merhav (25%) as well as Ampal-American Israel Corp. (6.6%), has been granted the rights to export natural gas from Egypt to Israel and other locations in the region via underwater pipelines from Al 'Arish to Ashkelon which will provide Israel Electric Corporation (IEC) 170 million cubic feet (4.8×106 m3) of gas per day. Gas supply started experimentally in the second half of 2007. Exporting natural gas to Israel faces broad popular opposition in Egypt. As of 2008, Egypt produces about 6.3 billion cubic feet (180×106 m3), from which Israel imports of 170 million cubic feet (4.8×106 m3) account for about 2.7 % of Egypt's total production of natural gas. According to a statement released on 24 March 2008, Merhav and Ampal's director, Nimrod Novik, said that the natural gas pipeline from Egypt to Israel can carry up to 9 billion cubic meters annually which sufficiently meet rising demand in Israel in the coming years. According to a memorandum of understanding, the commitment of Egypt is 680 million cubic feet (19×106 m3) contracted for 15 years at a price below $3 per million of British thermal unit. As of June 2009 it was reported that Cairo sources said Israelis will dig for oil in Sinai[21]. This report comes in the time in which the government is heavily criticized for exporting natural gas to Israel at an extremely low rate. http://en.wikipedia.org/wiki/Economy_of   http://www.lib.utexas.edu/maps/atlas_mi Геология http://spilpunt.blogspot.com/2007/04/eg Египет, Горная энциклопедия http://dic.academic.ru/dic.nsf/enc_geol |

| 6:02p | Египет: нефть и газ Date of Oil Discovery: 1907 Date of Oil Production: 1914 http://www.oapecorg.org/en/aboutus/memb Обзор http://www.eia.doe.gov/cabs/Egypt/Backg http://www.egyptoil-gas.com/ Карта концессий http://www.egyptoil-gas.com/concession_ BP Statistical Review of World Energy 2010  ( Read more... )  http://countryproductionprofiles.blogsp  http://www.pico-petroleum.com/PIPStruct Oil and Gas in Egypt - Overview http://www.mbendi.com/indy/oilg/af/eg/p http://www.africanoiljournal.com/eg http://www.suco-eg.com/ Shell Egypt N.V. http://202.244.105.132/English/Data/Afr BP, RWE Dea move on Egypt plans http://www.oilonline.com/News/NewsArtic  http://www.vegasoil.com/en/main.php http://www.apachecorp.com/Operations/Eg http://www.offshoreenergytoday.com/aust |

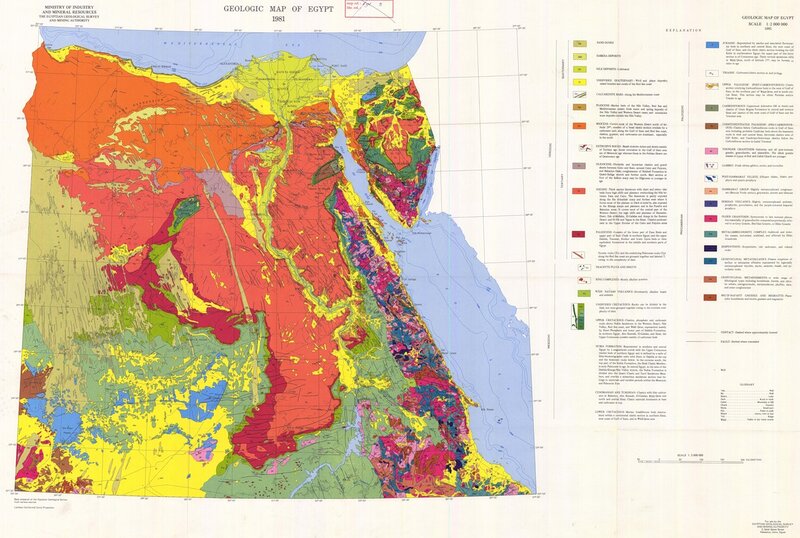

| 6:44p | Египет: геология и нефтегазоносность Geology of North Africa and Arabia Information, Exchange and Research Egypt Geology Links http://www.northafrica.de/egypt.htm Geology of Egypt http://www.4shared.com/file/58794347/4d Карты http://eusoils.jrc.ec.europa.eu/esdb_ar Геологические карты  ( 7472×5025 )  ( 3666×2427 )  ( 2361×2782 )  ( 4500×6907 ) 09 Jul 2009. Egypt: Two bid rounds launched http://www.energy-pedia.com/article.asp Egypt Oil and Gas Infrastructure http://www.woodmacresearch.com/cgi-b http://www.hoeckmann.de/karten/afrika/a http://www.cgmme.com/Article.aspx?CId=E Тектоническая карта: Ближний и Средний Восток  http://iv-g.livejournal.com/185541.h Сейсмотектоническая карта Ближнего и Среднего Востока http://iv-g.livejournal.com/224965.h Дельта Нила http://iv-g.livejournal.com/183299.h http://iv-g.livejournal.com/170928.h Levant Basin Province, Eastern Mediterranean http://iv-g.livejournal.com/183782.h Суэцкий рифт http://en.wikipedia.org/wiki/Gulf_of_Su The Red Sea Basin Province: Sudr-Nubia(!) and Maqna(!) Petroleum Systems http://pubs.usgs.gov/of/1999/ofr-99-005 Cenozoic evolution of the Red Sea and Modern Lithospheric Structure http://www.utdallas.edu/~rjstern/eg Статьи: ( Read more... ) - - - - - - - - - - - - - - E. Tawadros. Geology of Egypt and Libya http://www.amazon.com/Geology-Egypt-Lib The geology of Egypt http://www.worldcat.org/title/geology-o |

| << Previous Day |

2010/08/25 [Calendar] |

Next Day >> |